Audit Procedures for Cash and Cash Equivalents

Cash resources means cash in form of Bank notes or coins. Under billings on work in progress.

Audit Cash And Cash Equivalents Pdf Cheque Deposit Account

11405 Audit Requirement for Non.

. It proves to be a prerequisite for analyzing the business. A Form 1099 Information Return or its foreign equivalents. Auditor-General means the Auditor-General appointed in accordance with the Constitution.

As noted in Table 2 the system had approximately 114 million in cash and cash equivalents in local bank accounts and approximately 793 million in the state treasury at June 30 2012. Automatically generate reports for regulators and partners. Through an examination treatment stream this campaign will concentrate on bringing into compliance those.

1 Page 1 of 17 AUD Handouts No. Here we discuss Types of Audit report opinion and Sample Audit Report examples including Facebook Tesco Plc. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

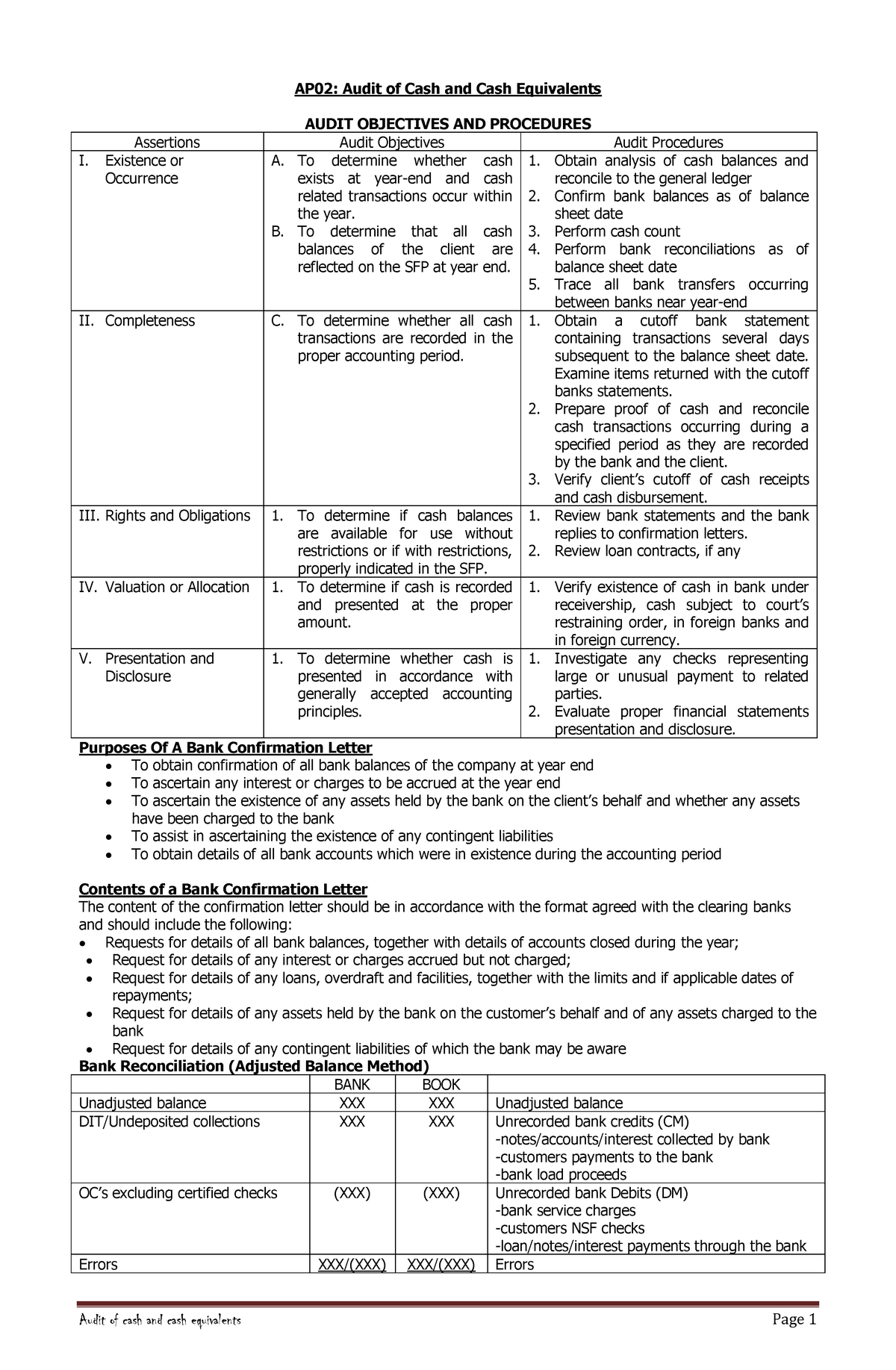

Departmental procedures should incorporate the principles of good cash handling which include the following. Cash and Cash Equivalent is scoped under IAS 7 Statements of Cash Flows. The second is Cash Equivalents which are investments that are short-term highly liquid and are readily convertible to.

Marketable securities representing the investment of cash available for current operations including investments in debt and equity securities classified as trading securities. Properly filled out this form will satisfy the requirements of Regulations Parts 3 and 5 29 CFR. Cash Equivalents For purposes of the statement of cash flows the Company considers all highly liquid debt instruments with a maturity of three months or less to be cash equivalents.

Staff must review procedures annually as a refresher. All cash and bank audit procedures need to be properly documented and all. In addition they must review updated departmental procedures as provided by unit management in a timely manner.

We recommend reviewing policies and procedures every January. Cash and paper money US Treasury bills undeposited receipts. Help your team handle сompliance.

Audit committee means a committee established under section19. Cash cash equivalents and short-term investments totaled 965 billion as of June 30 2015 compared with 857 billion as of June 30 2014. Cash purchases and sales of cash and cash equivalents.

Multiple series registrants should include in the controls and procedures disclosure of their periodic reports a statement that the CEOCFO certifications are applicable to each of the. This is a statement of the companys cash and cash equivalents Cash And Cash Equivalents Cash and Cash Equivalents are assets that are short-term and highly liquid investments that can be readily converted into cash and have a low risk of price fluctuation. Equity and other investments were 121 billion as of June.

Form WH-347has been made available for the convenience of contractors and subcontractors required by their Federal or Federally-aided construction-type contracts and subcontracts to submit weekly payrolls. In Cash and Cash Equivalents there are two separate components. This will help the auditor to plan audit procedures for cash and cash equivalents.

Assets and liabilities for which the turnover is quick and the maturities are three months or less such as debt loans receivable and the purchase and sale of highly liquid investments Cash Flows from Operating Activities. Auditing Cash and Cash Equivalents. Cash Cash Equivalents and Investments.

ASUNCION CPA MBA DEFINITION OF CASH Cash includes money and other negotiable instrument that is payable in money and acceptable by the bank for deposit and immediate credit. 26 Cash flow statement Cash flows are reported using the indirect method. They will need to get idea about the number of banks types of bank accounts authorized signatories authorization matrix bank payment process petty cash payment process etc.

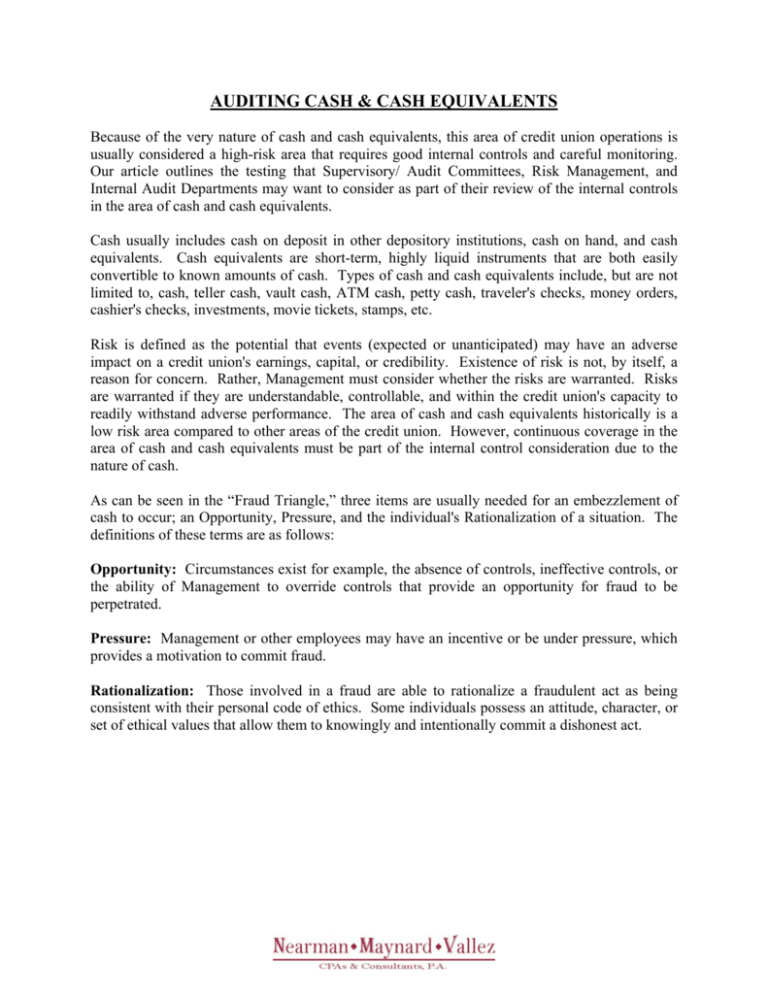

An audit report is an independent opinion of a personfirm ie. Get 247 customer support help when you place a homework help service order with us. Cash control is cash management and internal control over cash.

Auditor about whether the financial statements present a true fair view of the state of affairs of the entity profitloss of the entity cash flows for the year and such opinion is given after performing reasonable audit procedures so obtain sufficient appropriate evidence for the assurance. It is a written plan that allows your employees to choose between receiving cash or taxable benefits instead of certain qualified benefits for which the law provides an exclusion from wages. Controlling cash receipts and cash disbursements reduces erroneous payments theft and fraud.

Assets consisting of any amount of cash and cash equivalents and nominal other assets. It includes cash on hand demand deposits and other items that are unrestricted for use in the current operations. Cash and cash equivalents available for current operations.

Automate processes construct unique verification flows and investigate cases in-depth all in a few clicks. Cash equivalents are short-term balances with an original maturity of three months or less from the date of deposit highly liquid investments that are readily convertible into known amounts of cash and which are subject to insignificant risk of changes in value. WH-347 PDF OMB Control No.

LBI Industry Guidance 04-0118-007 dated 212018 established procedures to ensure waiver requests are applied in a fair consistent and timely manner under the regulations. The first is cash which comprises cash on hand and at the bank. 05 DARRELL JOE O.

Bank account means an account at a bank into which moneys are deposited and drawn. Regulation C Rule 405. Cash and Cash Equivalents for Year Ended June 30 In Thousands Carrying Amount 2012 2011 2010 Cash in bank 56362 60809 46487.

A cafeteria plan including an FSA provides participants an opportunity to receive qualified benefits on a pre-tax basis. Inventories to include materials andor houses built for sale. Accounts Receivable Trade accounts receivable are stated net of an allowance for doubtful accounts of 7500 at December 31 20YY and 20XX.

Internal control includes corporate governance company policies segregation of duties authorized approvals for purchases designated signature authority with limits payments reconciliation and bank. Has audited Income Statement Balance Sheet Cash Flow Cash Flow Cash Flow is the amount of cash or cash equivalent generated consumed by a Company over a given period.

Pdf Audit Of Cash And Cash Equivalents Compress

Audit Of Cash And Cash Equivalents Existence Or Occurrence A To Determine Whether Cash Exists At Studocu

Audit Cash Cash Equivalents Youtube

Auditing Cash Cash Equivalents

0 Response to "Audit Procedures for Cash and Cash Equivalents"

Post a Comment